Options + AI:

Superior Returns

Options investment instructions at your fingertips, augmented with machine intelligence.

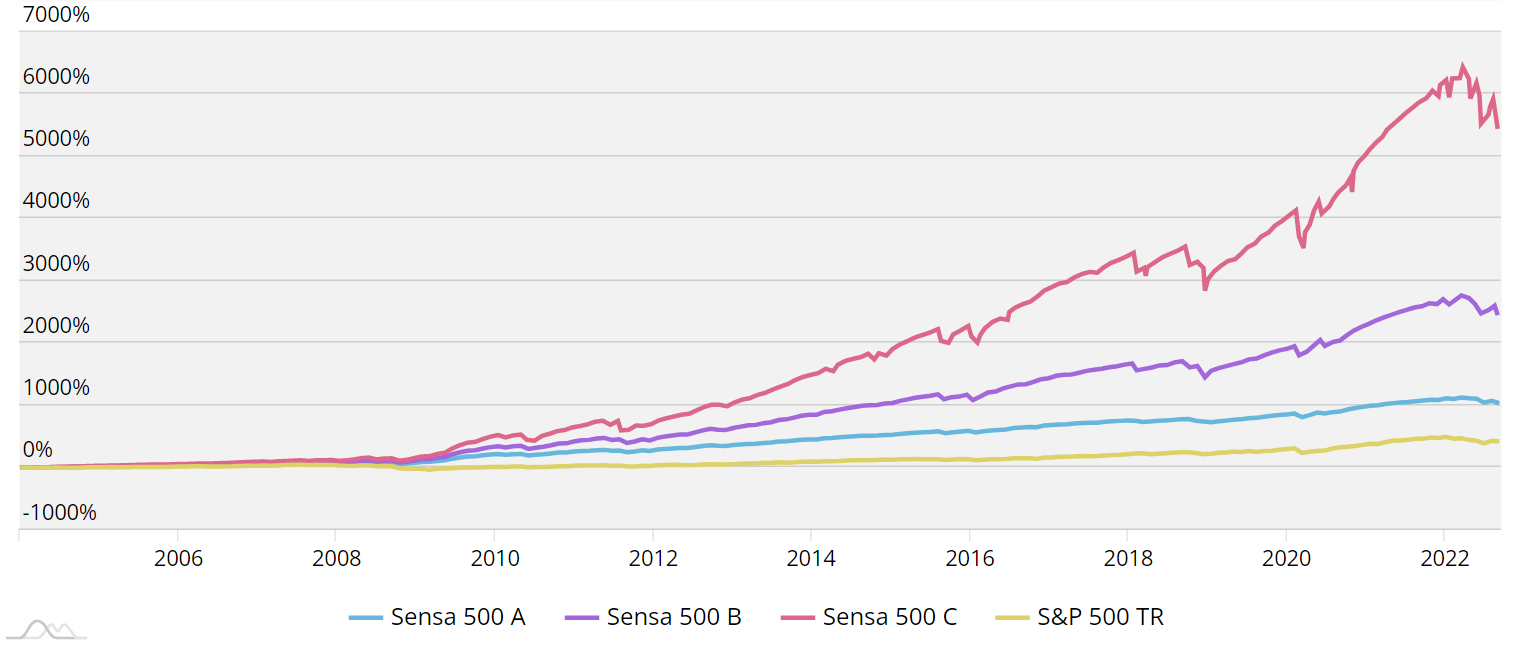

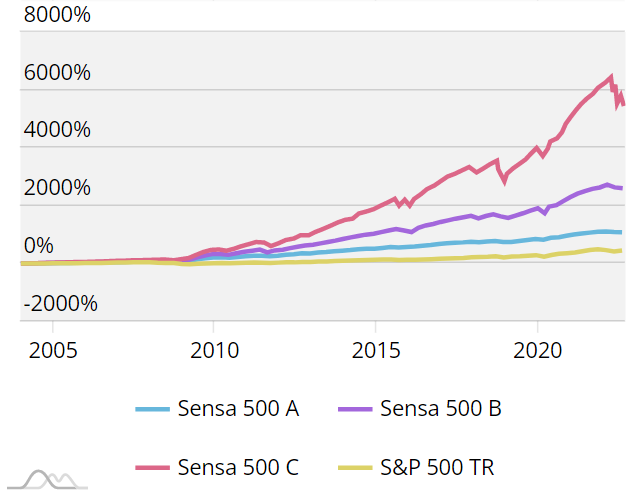

| Ann. Return | Volatility | |

| Sensa 500 A | 14.0% | 10.0% |

| Sensa 500 B | 19.1% | 14.3% |

| Sensa 500 C | 24.2% | 18.3% |

| S&P 500 Index | 8.9% | 19.4% |

What You Get

Clear investment instructions backed by rigorous research, back-testing and machine learning algorithms delivered directly to your inbox.

Superior Returns

Our options based investment strategies have historically significantly outperformed the underlying benchmarks both on an absolute and on a risk adjusted basis.

Clear Investment Instructions

Our systems continuously monitor the full range of options on selected indices in real time and automatically issue clear trade instructions.

Realistic Investment Strategy

Diversified Option Strategies

Risk Management

–

Benefits of Machine Learning

We utilise machine intelligence to optimise investment strategies and extract information from the markets that humans can’t.

Superior Historic Returns

Significant outperformance vs. underlying index at a lower level of volatility.

S&P 500 TR = Total return of the S&P 500 index including reinvested dividends.

Product Range to Suit Your Risk Profile

We offer three products ranging from low over moderate to higher risk and with historic returns reflecting these risk profiles.

Low Risk

Historic returns in line with the S&P 500 however with a significantly lower level of volatility of returns.

Historic Performance (Since 2004)

Annualised Return: 14.0%

Cumulative Return: 1,136%

Volatility of Returns: 10.0%

Sharpe Ratio: 1.28

Moderate Risk

Historic Performance (Since 2004)

Annualised Return: 19.1%

Cumulative Return: 2,759%

Volatility of Returns: 14.3%

Sharpe Ratio: 1.25

Higher Risk

Historic returns significantly above the S&P 500 with a similar level of volatility of returns.

Historic Performance (Since 2004)

Annualised Return: 24.2%

Cumulative Return: 6,285%

Volatility of Returns: 18.3%

Sharpe Ratio: 1.26

Financial Fundamentals Augmented by Machine Learning

A strong mix of financial and technological knowledge applying modern machine learning technologies to fundamental financial analysis.

Research Driven

Our method is grounded in fundamental finance principles, rigorous quantitative research with tested models and strategies.

Technical Knowledge

A passion for data science and a strong belief that machine learning can uncover tendencies in historical data more efficiently than could be done by humans.

Investment Experience

25 years of experience of investing in financial markets across multiple asset classes.–

Getting Started is Easy

We have a streamlined sign-up process and you receive 30 days free trial which you can cancel at any time.

STEP 1: Product Decision

You study our products in detail and decide which product best fits your personal risk appetite and profile.

Please feel free to reach out to us with questions at any time as you familiarise yourself with our product range.

STEP 2: Sign Up

You sign up for your chosen product and receive 30 days free trial which you can cancel at any time – no questions asked. No payment card information needed for free trial.

STEP 3: Portfolio Establishment

We provide you access to the current product position in order for you to establish your starting portfolio position.

STEP 4: Ongoing Portfolio Updates and Trade Instructions

We continuously monitor the markets in real time and send you clear instructions when you need to adjust your option position based on our models and prevailing market conditions (on average every other week but this can vary significantly based on market conditions).

Please check frequently asked questions for further details on how to get started. Please also feel free to contact us directly with any questions you may have.

Frequently Asked Questions

What is Sensa Investments?

Sensa Investments is a financial content portal offering actionable investment strategies based on investment algorithms enhanced with machine learning.

Sensa Investments is not an investment advisor or Broker/Dealer. We are an educational site and we do not engage in transactions or provide any investment advice or strategy. No information on the site constitutes the sale, purchase or recommendation of any security.

We would like to stress the second part of our name ‘Investments’. We consider ourselves investors first and traders second. All our products are based on a long-term investment horizon and we do not engage in or recommend short term highly volatile trading strategies offering outsized (and unrealistic) short term gains.

How do I use your products?

After you sign up to a product you will start receiving trade instructions by email when our investments algorithms find it favourable to close out existing positions and open a new position. You then simply need to follow the instructions given in order to use the product.

In addition to email instructions, we also offer an application programming interface (API) where you can request information directly utilizing your favourite programming language (we use Python for our own scripts) and implement in your own trading scripts/strategies.

You can also always log in to your account on our website and click the link in your dashboard to your subscription where the current investment recommendation will be shown.

If you don’t have a lot of prior knowledge trading options, we strongly recommend that you paper trade them for a couple of months until you feel comfortable enough undertaking the trades in your own account.

What are the differences between the different risk profiles you offer?

The main (but not only) difference is the implied leverage (the number of options written for specific level of collateral) which result in smaller drawdowns and less volatility for the more conservative products but conversely also in lower historic and expected returns.

What is the minimum account size needed to follow the product?

The minimum collateral required depends on product you decide to subscribe to but start at around US$150,000 if you decide to utilize traditional SPX options. However, you can also choose to utilize S&P mini-options (XSP) which trade at a 10 times smaller multiplier compared to SPX options and thus the minimum collateral required to follow the product is consequently also 10 times lower or around US$15,000.

The trade alerts will be based on regular SPX options. So, to implement the strategy, exactly as presented in the trade alerts, the minimum recommended collateral requirement is around $150,000. Again, as the underlier between traditional SPX options and XSP mini-options is exactly the same (S&P 500 index) the strategy can be implemented in smaller accounts as well.

How much time do I need to commit to follow the strategy?

Our products are long term investment strategies and we attempt to maximize returns while keeping trading frequency relatively limited. Historically our trading algorithms have resulted in trade instructions on average once every three weeks.

In other words, you should be able to follow the strategy with a relatively limited time commitment.

How should I invest my collateral allocated to the strategy?

You are of course free to invest your collateral as you please and it also depends on what proportion of your overall wealth you are allocating to our products. In all circumstances we recommend that you invest it very conservatively.

All our products assume that the collateral is invested in 1 month T-Bills but depending on your risk appetite and return aspirations you may consider investing slightly less conservatively.

Still have questions?

Recent Articles from our Blog

Introduction to Options Contracts

In this lesson we provide a brief introduction to options contracts. First, we discuss what an option contract actually is. We then move on to an introduction to some basic characteristics of options before providing a couple of simple examples of options. Lastly, we...

The Structure of the Global Options Market

In this lesson we provide a brief overview of the structure of the global options market including over-the-counter options and the exchange-listed options.

The Most Common Types of Options

Almost anything with a random outcome can have an option on it. In this reading we will learn about the many types of options, which are distinguished by the nature of the underlying.

Contact Us