Introduction

This guide serves to provide insights on how to use a Sensa Investments’ product after a user has subscribed on the platform. For insights on how the sign-up process works please refer to our separate guide describing this process.

We have attempted to keep this guide as short and to the point as possible. It should hopefully answer the important aspects of how to use our products. Should you have further questions on how to use our products please do feel free to reach out to us at any time and we will endeavour to answer you as quickly as possible.

Position Establishment

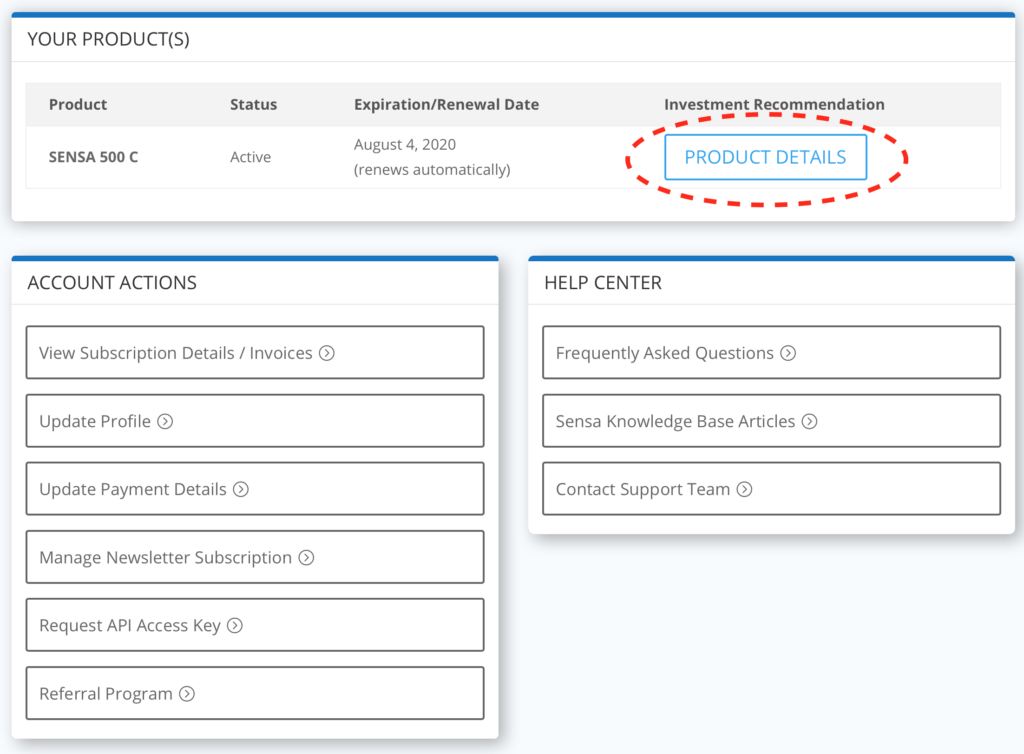

Upon signing up for a trial subscription on our platform (or for a fully paid subscription in case you have already had a trial period for one of our products) you will immediately be provided access to your account Dashboard.

In the top half of your account Dashboard you will see the product you have subscribed to. You can click the “Product Details” button to be taken to an overview of the current product recommendation.

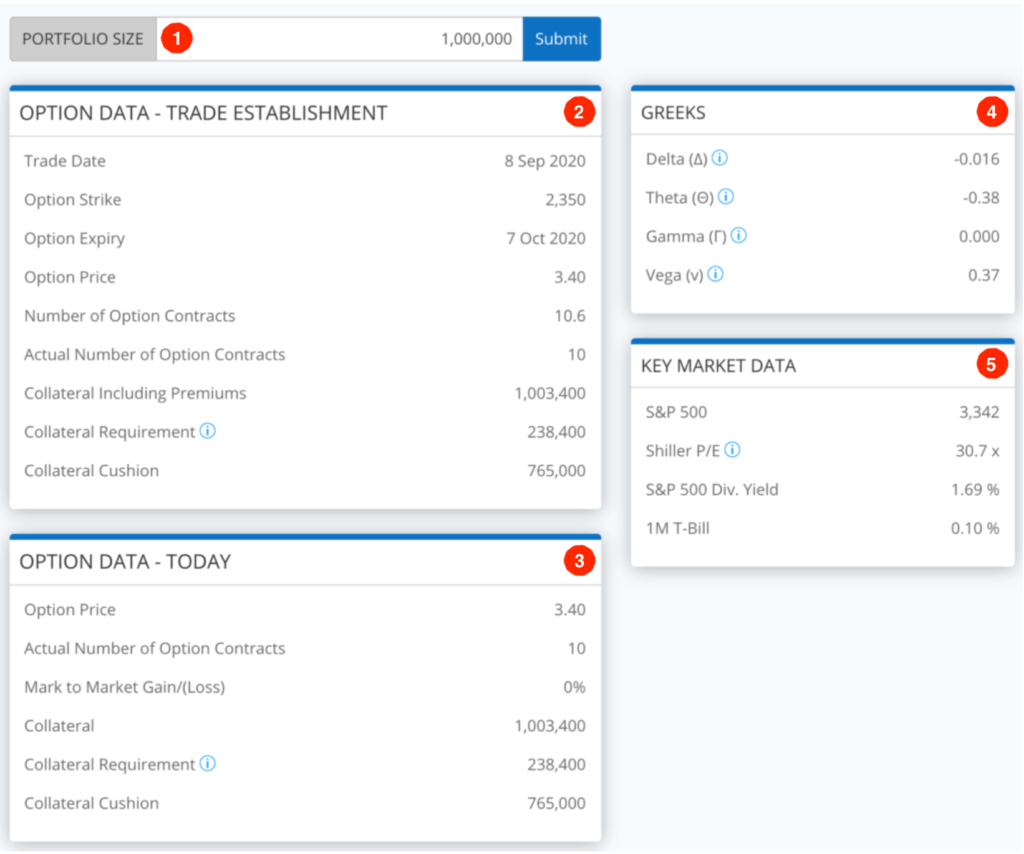

The product details overview will give you an overview of the current option position recommendation for the product.

1. Portfolio Size

At the top of the page you will need to input the collateral amount you are intending to allocate to the product. The default amount is USD 1,000,000 but you can of course input as small or large amount as you wish depending on the collateral you are willing and able to allocate to the product. Please do keep in mind that if you decide to utilize traditional SPX options the minimum collateral (depending on the product you decide to subscribe to) starts at around US$150,000. However, you can also choose to utilize S&P mini-options (XSP) which trade at a 10 times smaller multiplier compared to SPX options and thus the minimum collateral required to follow the product is consequently also 10 times lower or around US$15,000.

How should I invest my collateral allocated to the strategy?

You are free to invest your collateral as you please and it also depends on what proportion of your overall wealth you are allocating to our products. In all circumstances we recommend that you invest it very conservatively.

All historic return representations of our products assume that the collateral is invested in 1 month T-Bills but depending on your risk appetite and return aspirations you may consider investing slightly less conservatively for a higher return expectation.

2. Option Data — Trade Establishment

The first block of option data on the page shows option data at the time of the position establishment. The most important parts of information needed in order for you to identify the specific option you will need to write are the option strike price and option expiry date. Additionally you will need to pay attention to the “Actual Number of Option Contracts” to be written which has been calculated based on your desired collateral allocation. As you can’t write partial option contracts this number has been rounded down to the nearest whole number from the number of option contracts shown just above. If the number of option contracts shown above is close to a whole number and you are being relatively conservative with you collateral allocation to our product (in relation to your overall wealth) you may consider rounding up instead of round down.

You may also consider combining traditional SPX and XSP options (as described above) to fully utlilize you available collateral, as XSP options require 10 times less collateral per contract than traditional SPX options. So assuming the number of SPX options contracts based on your collateral amount input was 2.5 you could write 2 SPX option contracts at the recommended strike and expiry and write an additional 5 XSP option contracts fot the same strike and expiry thus creating the equivalent exposure of 2.5 SPX option contracts.

Please note that if you have just subscribed to a product and the current recommended option contract is within a few days of expiry you may want to wait until you receive your first Trade Alert email (as described further below) before establishing your position. The rationale behind this is to avoid suffering trading costs (although very low on a relative basis for SPX options) and spread costs for a position you will only hold for a couple of days at most.

3. Option Data — Today

The second block of option data shows a few data points for the option position as of the current date (updated every 15 minutes during exchange opening hours) including the current mark to market gain or loss of the position based on the current market price if the option as well as your current collateral position. We compare your collateral position to the current collateral required based on exchange requirements (broker requirements may vary) and the resulting collateral cushion compared to you actual collateral position. If you are using collateral which are not in cash or in a very conservative government backed instrument please do bear in mind that your actual collateral position may be different based on market movements since trade establishment. At trade establishment all our products will have a collateral requirement significantly below the actual collateral exchange implied requirement for the product).

4. Greeks

This block gives you an overview of the current Greeks for the option position. Please refer to our blog article Option Greeks Explained for a definition of the most important option greeks.

5. Key Market Data

This block provides a couple of high level market data points for the underlying index. Our focus is not provision of detailed market information so do please refer to other sources for more detailed / live market data.

Ongoing Portfolio Updates and Trade Instructions

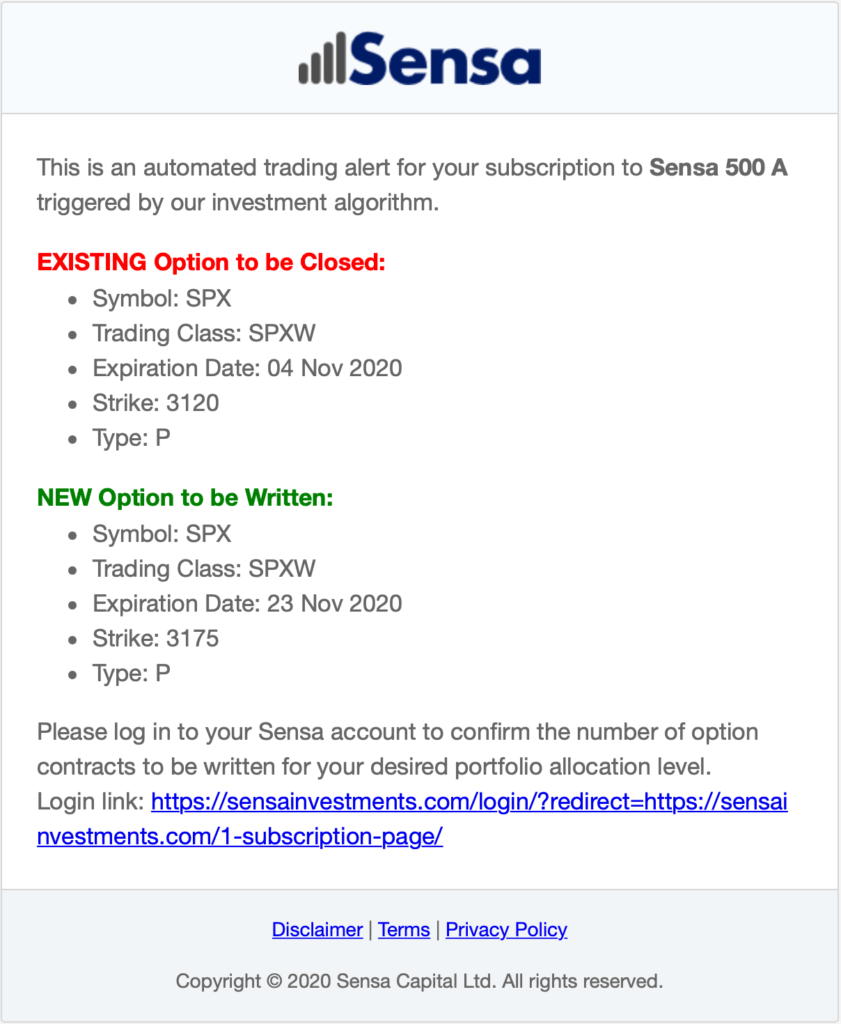

After signing up to one of our products you will start receiving trade alerts emails (and SMS alerts if you have provided a mobile phone number in your profile information). The trade alerts are driven by our algorithms depending on a number of market inputs both in relation to the overall market as well as specifically for the current option position. As such we can’t predict with certainty how long after your sign up the first alert will be issued. Historically trade alerts have been issued on average every 3 weeks but this can vary significantly depending on market conditions.

The trade alerts (please see example below) will specifically inform you of the existing option position to be closed as well as the new option to be written. In order to confirm the specific number of option contracts to be written, please log in to your account to input your collateral amount in the product details overview as described in the Portfolio Establishment section above. The trade alert email will provide you with a direct link to this page for your specific product which you will be redirected to after logging in to your account.

How you place your opening and closing orders will depend on your brokerage account so please refer to instructions provided by your specific broker.

0 Comments